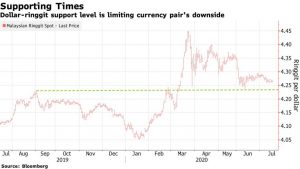

Malaysian Ringgit Far from over The Malaysian ringgit has been among the worst performing Asian currencies so far this year and its challenges are far from over.

Political and economic headwinds have buffeted the ringgit while a rebound in crude prices has been one of the few supporting factors for the oil-exporting nation. However, downside risks to oil are growing amid OPEC+ plans to taper output cuts, making the ringgit vulnerable to declines beyond its 4.23-4.25 per dollar support level.

“We are hesitant in turning bullish on the ringgit,” said Divya Devesh, head of Asean and South Asia FX research at Standard Chartered Bank Plc in Singapore. He forecasts the ringgit will fall to 4.30 per dollar by the end of this quarter.

With oil prices on shaky ground, all eyes will be on Malaysia’s inflation data this week which is forecast to remain in the deflationary territory for the fourth month. That’s expected to hurt the ringgit, as it leaves the door open for further interest rate cuts, particularly since Bank Negara Malaysia warned of downside risks to the economy at a policy meeting earlier this month.

Political uncertainty has been a drag on the currency ever since Mahathir Mohamad abruptly resigned as Prime Minister earlier this year. Muhyiddin Yassin replaced him but his grip on power still appears tenuous after he narrowly won a parliamentary vote, indicating that snap election remains a risk.

The ringgit’s litany of woes doesn’t stop there. It’s is also weighed down by concerns that FTSE Russell may exclude the nation from its World Government Bond Index in September, after it was left on its watchlist over market accessibility issues. Last year Goldman Sachs Group Inc. estimated that the exclusion could see $5 billion to $6 billion in outflows on a one-time basis.

However, a weaker dollar could lend support to the ringgit on better-than-expected global economic recovery and positive news on a coronavirus vaccine development.

Read more about Malaysian Ringgit Far from over over at Bloomberg https://www.bloomberg.com/news/articles/2020-07-19/headwinds-for-the-malaysian-ringgit-are-only-getting-stronger.

As usual, are you a money changer? Join us by leaving your contact here directly and stand to gain our whole suit of software and hardware for free to help digitize your business. 🙂

Missed our recent news? Catch up on news here https://stories.cashchanger.co

Do catch us on:

Web: https://cashchanger.co | https://remit.cashchanger.co/

Telegram: https://cashchanger.co/telegram

Facebook: https://fb.me/cashchanger

Instagram:https://www.instagram.com/cashchangercom/