SGD rises to 17 month HIGH versus Malaysian RM – SINGAPORE 18th April 2019: The Singapore dollar rose to a 17-month high against the Malaysian ringgit on Wednesday, as demand for the RM weakened following concerns the country’s debt may be removed from a key global bond index.

According to Investing.com, SGD rose to an intraday high of RM3.0632 yesterday, the highest since SGD touched RM3.0724 on Nov 20th in 2017.

Bloomberg reported that for the year to date, the SGD has risen 0.74 per cent against the RM.

The global index provider FTSE Russell, said on Monday it could drop Malaysia from the FTSE World Government Bond Index (WGBI) because of concerns about liquidity & market accessibility.

This led to Morgan Stanley saying in a research note that Malaysia could see outflows of nearly US$8 billion if its bonds are downgraded when FTSE Russell carries out its review in September.

Phillip Capital Management SVP of Investments Dr Nazri Khan Adam Khan – said concerns over the potential downgrade had influenced investors’ risk-appetite, and expects the ringgit downtrend to prolong until the end of this week, although the impact might be temporary.

“Our foreign fund (selling) has stabilised, so supposedly the outflow will stabilise soon. This concern (FTSE Russell) is just a knee-jerk reaction,” he told Bernama.

“The government needs to address this concern of bond managers and boost their confidence.”

In its first Fixed Income Country Classification Review, FTSE Russell placed Malaysia and China under its full watch list of fixed income markets that will be reviewed for potential changes to their market accessibility levels.

Malaysia, currently assigned a “2” and included in the WGBI since 2004, was being considered for a potential downgrade to “1”, making it ineligible for inclusion, FTSE Russell said.

FTSE Russell said it would continue to engage with local regulators and market participants in Malaysia and China to assess the potential changes to a country’s classification. The position of Malaysia and China would be reassessed in September, with any exclusion or inclusion changes taking place after that date.

As always, do ping us directly for any feedback, and we’ll be happy to hear what you have in mind.

Like CashChanger on Facebook and on join us on Telegram.

As always, do ping us directly for any feedback, and we’ll be happy to hear what you have in mind.

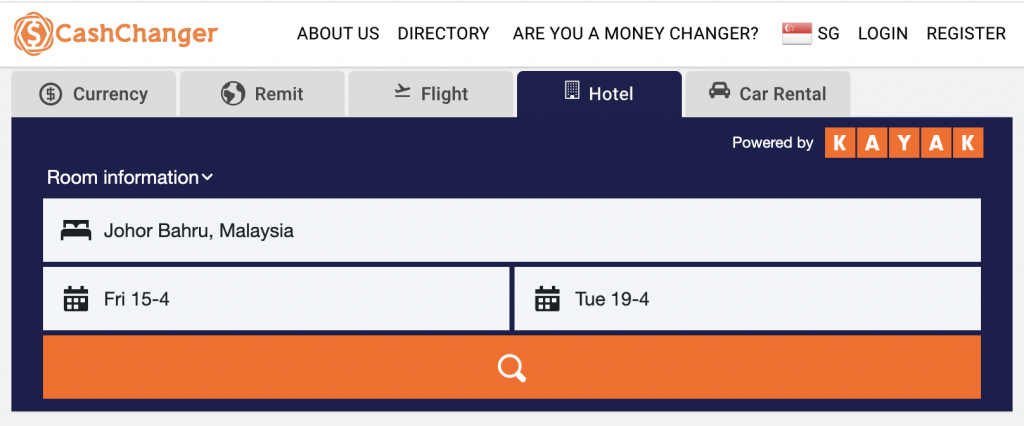

For hotel booking, you can check it at CashChanger at

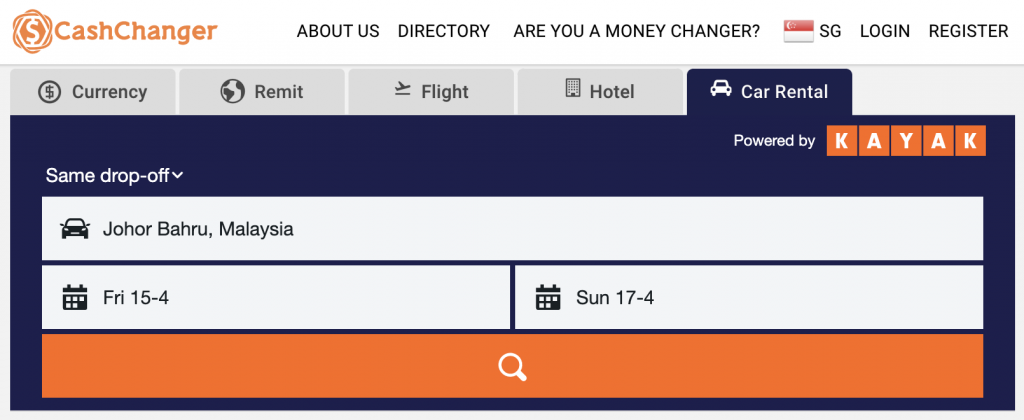

You can rent a car for easy access to more interesting places around Johor Bahru.

Like CashChanger on Facebook and on join us on Telegram.

As usual, are you a money changer? Join us by leaving your contact here directly and stand to gain our whole suit of software and hardware for free to help digitize your business. 🙂

Missed our recent news? Catch up on news like sgd rises to 17 month high here https://stories.cashchanger.co

Compare & get latest best Exchange rates #SGDMYR #MYRSGD #MYR #RINGGIT #MALAYSIARINGGIT #SingMalaysia #SingMY https://cashchanger.co/singapore/sgd-to-myr

Compare Remittance best rates to send money from #Singapore to #马来西亚 – https://remit.cashchanger.co/singapore/sgd-to-myr

Catch us on:

Web: https://cashchanger.co | https://remit.cashchanger.co/

Telegram: https://cashchanger.co/telegram

Facebook: https://fb.me/cashchanger

Instagram: https://www.instagram.com/cashchangercom/

#exchangerate #remittance #compareexchangerates #compareremittancerates #fxrates

Read more about Malaysia chickens out, bans exports to Singapore at https://www.malaymail.com/news/malaysia/2022/05/23/pm-chicken-exports-on-hold-until-shortage-problem-in-malaysia-solved-regrets-rising-prices/8402

Read more about Malaysia Ringgit hits low of 3.17 vs Singapore Sing Dollar USD MYR at https://www.freemalaysiatoday.com/category/nation/2022/04/22/at-rm4-30-to-usd-ringgit-at-its-lowest-since-may-2020/