Travelling with Multicurrency Cards – Today we share about how to use the Amaze card, or rather maybe how not to use the card when travelling to Malaysia! Compare & get latest best Exchange rates #MALAYSIA #SGDMYR #MYRSGD #MYR #RINGGIT #SingMalaysia https://cashchanger.co/singapore/sgd-to-myr

Multicurrency cards offer a range of advantages that make them a convenient and efficient option for travelers and individuals dealing with international transactions. Here are some key benefits of Travelling with Multicurrency Cards:

- Simplified Currency Management: With a multicurrency card, you can load multiple currencies onto a single card. This eliminates the need to carry multiple physical currencies or maintain separate accounts for each currency. You can easily switch between currencies as needed, making cross-border transactions simpler.

- Cost Savings: Traditional methods of currency exchange, such as exchanging cash or using your regular credit card, often come with high fees and unfavorable exchange rates. Multicurrency cards typically offer competitive exchange rates and lower fees, resulting in cost savings over time.

- Favorable Exchange Rates: Multicurrency cards often provide more competitive exchange rates compared to traditional banks or currency exchange services. This means you get more value for your money when converting between currencies.

- Avoid Currency Conversion Fees: When you use a regular credit card abroad, your bank may charge you a currency conversion fee for transactions in foreign currencies. Multicurrency cards can help you avoid these fees by allowing you to spend directly in the local currency, which is especially useful for online shopping or in-store purchases.

- Global Acceptance: Multicurrency cards are usually issued by major card networks like Visa or Mastercard. This means they are widely accepted around the world, just like regular credit or debit cards.

- Prepaid Convenience: Most multicurrency cards are prepaid, meaning you load the card with funds before using it. This can help you stick to a budget while traveling and avoid overspending. It’s also a security feature, as you’re not exposing your main bank account to potential fraud.

- Real-time Currency Management: Many multicurrency cards come with mobile apps or online platforms that allow you to monitor your balances and transactions in real-time. This makes it easy to keep track of your spending and available funds.

- Travel-Friendly: Multicurrency cards are a great choice for travelers as they offer the convenience of using local currency without the hassle of carrying large amounts of cash. They can also be used for booking accommodations, renting cars, and making online purchases without worrying about currency conversion.

- Security Features: Multicurrency cards often come with security features such as PIN protection, two-factor authentication, and the ability to lock or unlock the card through a mobile app. This adds an extra layer of security to your transactions.

- Emergency Backup: In case you run out of funds in one currency, multicurrency cards allow you to use funds from other currencies loaded on the card. This can be a helpful feature during emergencies or unexpected situations.

In summary, multicurrency cards offer a flexible and cost-effective solution for managing finances while traveling or dealing with international transactions. They provide favorable exchange rates, reduced fees, and the convenience of managing multiple currencies on a single card. Whether you’re a frequent traveler or someone who frequently deals with foreign currencies, a multicurrency card can simplify your financial transactions and help you save money.

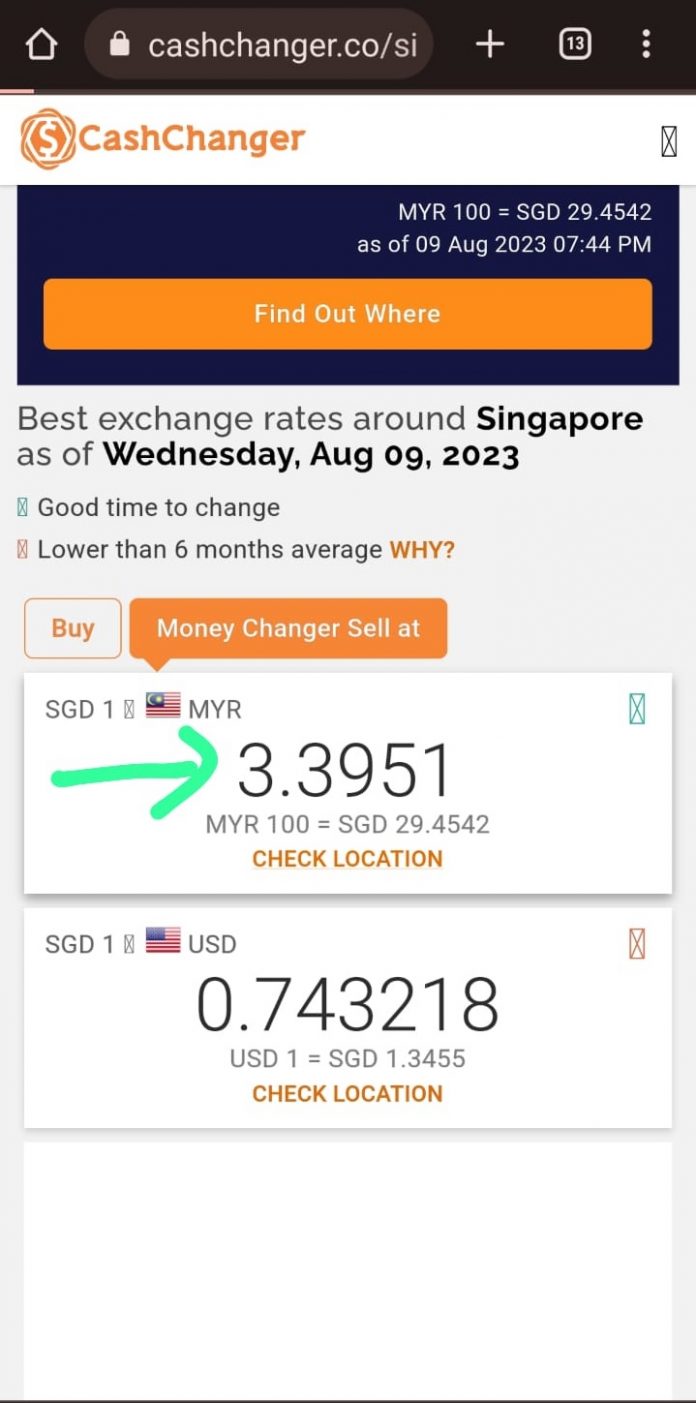

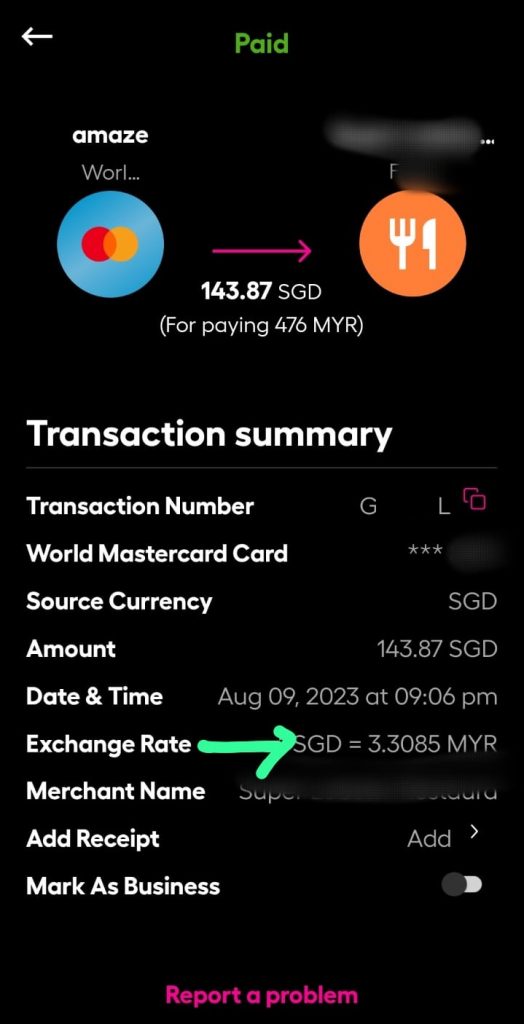

If you selected the card binding option like our user shared below, for a meal on National Day in Malaysia, he got the equivalent of 1 SGD to 3.3085 MYR, a poor rate, considering that Money changers were offering close to 3.4 MYR during the day.

For a MYR 476 meal, this works out to be a difference of about S$3.87 – nearly 2.7% difference for all monies spent.

As usual, are you a money changer? Join us by leaving your contact here directly and stand to gain our whole suit of software and hardware for free to help digitize your business.

Missed our recent news? Catch up on news like Travelling with Multicurrency Cards here https://stories.cashchanger.co/

Compare Remittance best rates to send money to Malaysia from #Singapore – https://remit.cashchanger.co/singapore/sgd-to-myr

Catch us on:

Web: https://cashchanger.co | https://remit.cashchanger.co/

Twitter: https://twitter.com/cashchanger

Telegram: https://cashchanger.co/telegram

Facebook: https://fb.me/cashchanger

Instagram: https://www.instagram.com/cashchangercom/

#exchangerate #remittance #compareexchangerates #compareremittancerates #fxrates