China Renews Push for Increased Global Role for the Yuan – faced with the prospect of restricted access to U.S. dollars, China’s answer is to get more people to use its own currency instead.

The increasing spillover of Sino-American tensions into the financial sphere has ignited a fresh push by China to promote the global use of the yuan. A growing number of government officials and influential market watchers have in recent weeks urged greater efforts on the endeavor, which gained renewed significance after China’s new Hong Kong security law triggered the threat of retaliation from Washington.

While such drastic action is far from being implemented by the U.S. — and could potentially do major damage to American interests and the entire global financial system — the risks alone have raised alarm bells. With almost a trillion dollars in offshore bonds and loans and $1.1 trillion in state-owned bank liabilities, access to the greenback is vital for Chinese companies and lenders.

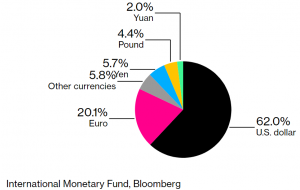

Tiny Share

Yuan took up 2% of global central banks’ reserves at end of first quarter

International Monetary Fund, Bloomberg

“Yuan internationalization morphed from a desirable to an indispensable thing for Beijing,” said Ding Shuang, chief economist for greater China and north Asia at Standard Chartered Plc. “China needs to find a replacement for the dollar amid the political uncertainty, otherwise the nation will see financial risks.”

Similar calls for moving away from the dollar followed the 2007-09 financial crisis. While China over the years made some progress — promoting offshore yuan trading, winning official reserve-currency status from the International Monetary Fund and launching commodity contracts priced in yuan — the renminbi is a small player on the global stage.

The yuan’s share in global payments and central bank reserves remains low, at about 2%. And while a steady opening of China’s financial markets to overseas investors has lured inflows, foreign ownership of mainland stocks and bonds is relatively minor.

Among the recent voices expressing urgency in China:

- Fang Xinghai, a top official at China’s securities regulator, said last month “our ability to defend against potential decoupling will be enhanced significantly” through yuan internationalization.

- Huang Yiping, a former adviser to the central bank, said it’s necessary for the country to reduce its reliance on the greenback.

- Zhou Li, an ex-deputy director of a government body that manages relations with foreign parties, decried China’s vulnerability to “dollar hegemony,” and said the greenback is a major risk that “has us by the throat.”

Zhou Yongkun, an official at the People’s Bank of China, said last week that the country will introduce direct trading between the yuan and additional currencies, without specifying which ones.

To accelerate reaching a par with counterparts such as the yen or euro, China would need to pull down its capital controls, which were tightened in the wake of a messy devaluation in 2015. But that would raise the risk of destabilizing outflows. China could alternatively expand imports and run persistent current-account deficits — as the U.S. does — to generate a pool of yuan balances overseas. That, too, would require a hard-to-envision policy shift.

“Yuan globalization is largely hinged on convertibility under capital account — which China is not yet ready for,” said Yu Yongding, a former adviser to the People’s Bank of China. “China is facing a severe challenge of a series of potential U.S. financial sanctions and we can’t even rule out the possibility that they may freeze China financial assets one day. I believe regulators have a contingency plan.”

What’s unclear is how hard the Trump administration is prepared to push. Moves to curb a government pension fund from investing in Chinese stocks are already under way, along with tighter scrutiny of Chinese companies’ listings on American exchanges. But systematically restricting access of the world’s second-largest economy to dollar funding and transactions would be a step unprecedented since the U.S. first tolerated unregulated use of its currency abroad in the 1960s.

Chinese regulators are building the China International Payment System to settle transactions outside the dollar-based platforms where the U.S. holds sway. Hong Kong, which supplies around half of the world’s offshore yuan liquidity, is also aiming to become a more prominent yuan trading center.

Hong Kong regulators last month kicked off the Wealth Management Connect, which will allow cross-border investments among residents of Hong Kong, Macau and southern China. The move has implications including boosting the yuan’s international use and testing capital-account opening, analysts have said.

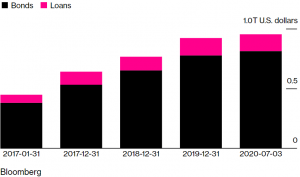

Boosting Holdings

Chinese institutions add dollar-denominated bonds and loans every year

Stronger steps could include China insisting on paying for some imports in yuan, making direct investments abroad in yuan and providing loans in renminbi — the currency’s official name. Still, the fact that over half of Hong Kong bank deposits are denominated in foreign currencies (led by the U.S. dollar) and Chinese banks themselves have about $747 billion in foreign-exchange deposits speaks to enduring demand in greater China for greenbacks.

“It’s not possible for China to have a significantly internationalized currency as things stand” now, said George Magnus, research associate at Oxford University’s China Centre and author of “Red Flags: Why Xi’s China Is in Jeopardy.”

With a global yuan still years or decades away, what’s left to China meantime could be the threat of countermeasures, and highlighting the global implications of the most extreme U.S. action. Chinese banks and offshore bonds have after all become key cogs in the world system.

“Cutting off the banking system’s U.S. dollar funding would be a serious blow — for this reason, I don’t expect it to happen” to mainland China, said Magnus.

— With assistance by Tian Chen, Jun Luo, Heng Xie, Ran Li, Shuqin Ding, Wei Zhang, and Yibo Zhang

As usual, are you a money changer? Join us by leaving your contact here directly and stand to gain our whole suit of software and hardware for free to help digitize your business. 🙂

Missed our recent news? Catch up on news here https://stories.cashchanger.co

Read more about China Renews Push for Increased Global Role for the Yuan at https://www.bloomberg.com/news/articles/2020-07-12/china-presses-global-yuan-role-as-u-s-tensions-explode-into-fx

Do catch us on:

Web: https://cashchanger.co | https://remit.cashchanger.co/

Telegram: https://cashchanger.co/telegram

Facebook: https://fb.me/cashchanger

Instagram:https://www.instagram.com/cashchangercom/